Why invest in INDEX?

INDEX is the new independent alternative. We are the index fund that offers “Index Voting Choice”, giving index investors a voice.

Fund Description and Objective

The ONEFUND S&P 500® seeks to replicate the total return of the S&P 500® Index before fees and expenses.

S&P 500® Index

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

S&P 500® Index Attributes

Created in 1957, the S&P 500® was the first U.S. market-cap-weighted stock market index. Today, it’s the basis of many listed and over-the-counter investment instruments. This world-renowned index includes 500 of the top companies in leading industries of the U.S. economy.

The S&P 500® is part of a series of S&P Dow Jones U.S. equity indices that can be used as mutually exclusive building blocks; the index does not overlap holdings with the S&P MidCap 400® or S&P SmallCap 600®. Together, they constitute the S&P Composite

Sectors

As of 03/31/24

- Information Technology - 29.6%

- Financials - 13.2%

- Health Care - 12.4%

- Consumer Discretionary - 10.3%

- Communication Services - 9%

- Industrials - 8.8%

- Consumer Staples - 6%

- Energy - 3.9%

- Materials - 2.4%

- Real Estate - 2.3%

- Utilities - 2.2%

Current and future portfolio holdings are subject to change. Holdings are subject to change.

FUND DETAILS

As of 03/31/24

A MINIMALIST INVESTMENT STRATEGY

ONE SIMPLE PLAN

1. Buy Index

2. Setup Auto Deposits

3. Own the Market Long-Term

4. Ignore the News

5. Live Your Life

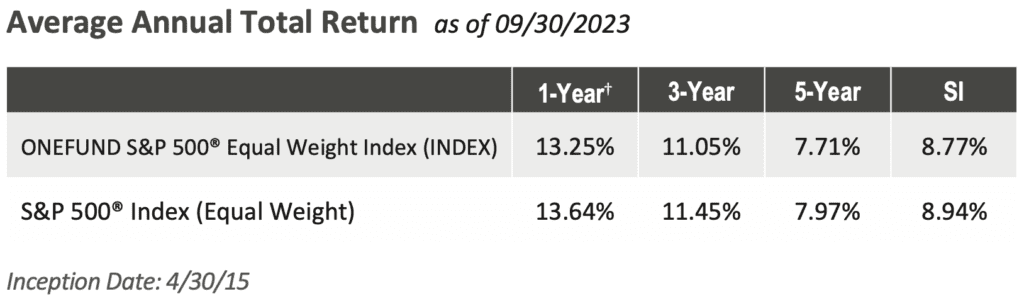

INDEX Performance

As of 09/30/23

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

The Hidden Battle for Control of Corporate America

Bogle's Last Warning

“If historical trends continue, a handful of giant institutional investors will one day hold voting control of virtually every large U.S. corporation…Three index fund managers dominate the field with a collective 81% share of index fund assets… Such domination exists primarily because the indexing field attracts few new major entrants.”

Wall Street Journal, 11.29.18

Jack Bogle: Founder of Vanguard and the First Index Mutual Fund

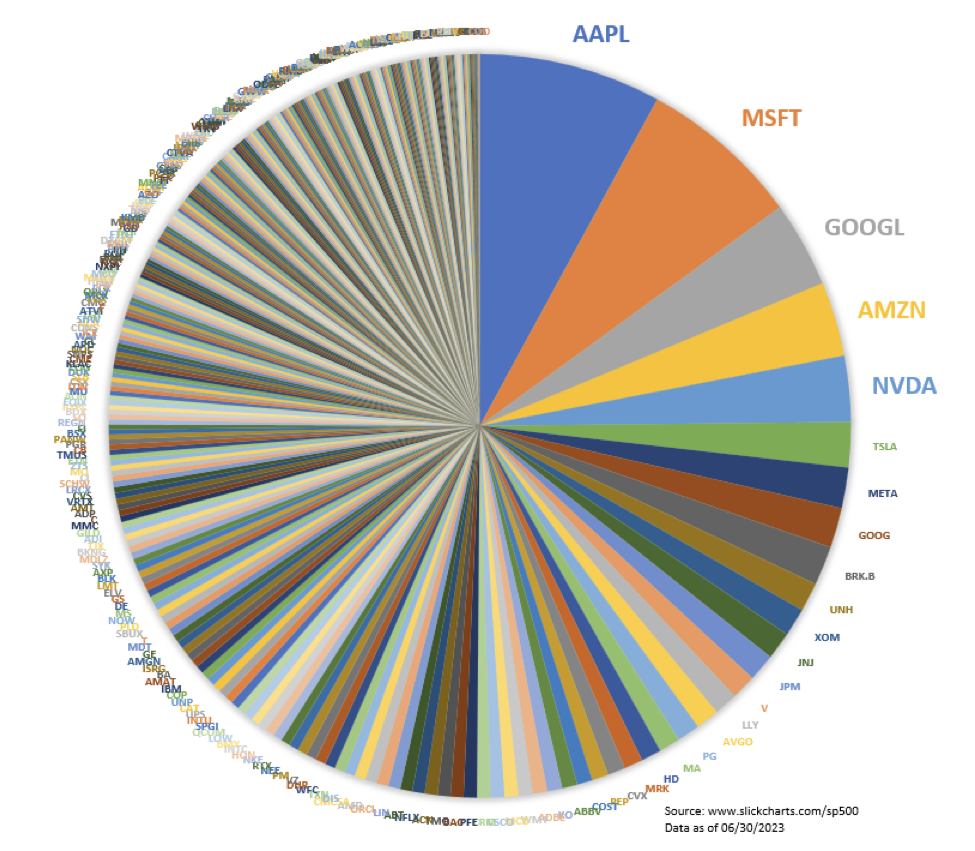

Interesting Market Cap Facts

As of 06/30/23

The Top 5 companies make up 23% of the index

The Bottom 100 companies make up 2.6% of the index

The Bottom 200 companies make up 7.4% of the index

Tech sector accounts for 36% of the portfolio*

*Combines Information Technology and Communications Services sectors

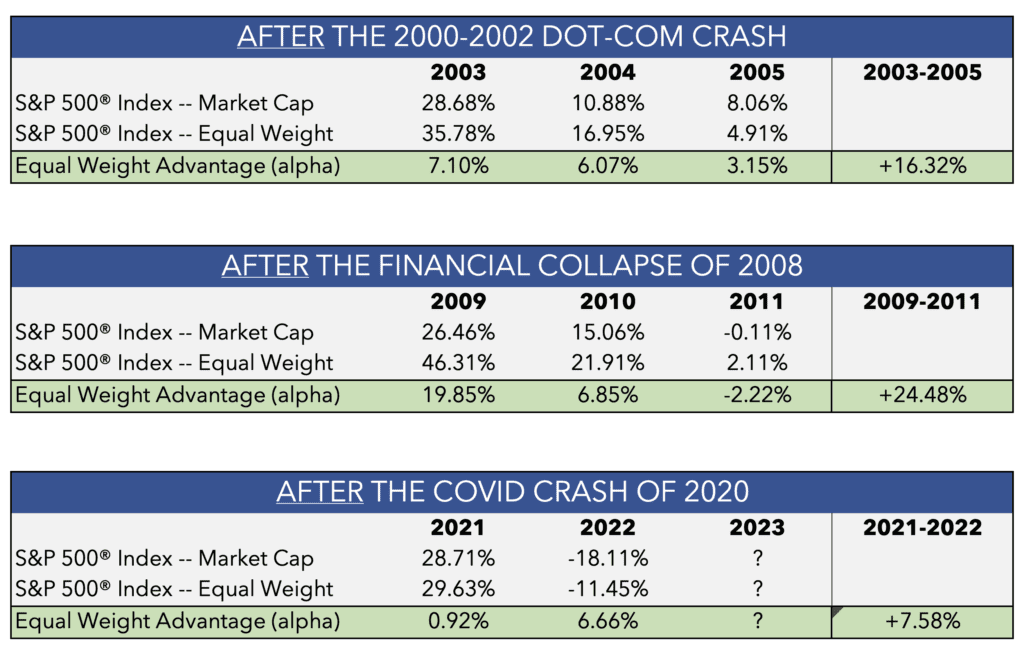

Better After Crash Index Strategy?

Directly following the last two largest stock market crashes, the S&P 500® EQUAL WEIGHT INDEX rebounded much faster than the MARKET CAP S&P 500® INDEX.

And the DIFFERENCE WAS SIGNIFICANT.

+13.17% from 2003-2004

+26.70% from 2009-2010

Past performance is not indicative of future results. Short term performance does not equal long term performance. Indexes are not managed, it is not possible to invest directly in an index.

*Source: ONEFUND as of 12/31/22