About INDEX

Own the top 500 Companies and call it a day. That strategy will put you ahead of 90% of Wall Street in our experience. You no longer have to be a Wall Street expert to be a successful investor, however it does matter what index you buy…

Our Values

What Makes INDEX Different?

Index Voting Choice gives investors a voice.

The non-institutional choice.

A fund run by real people who give shareholders a voice.

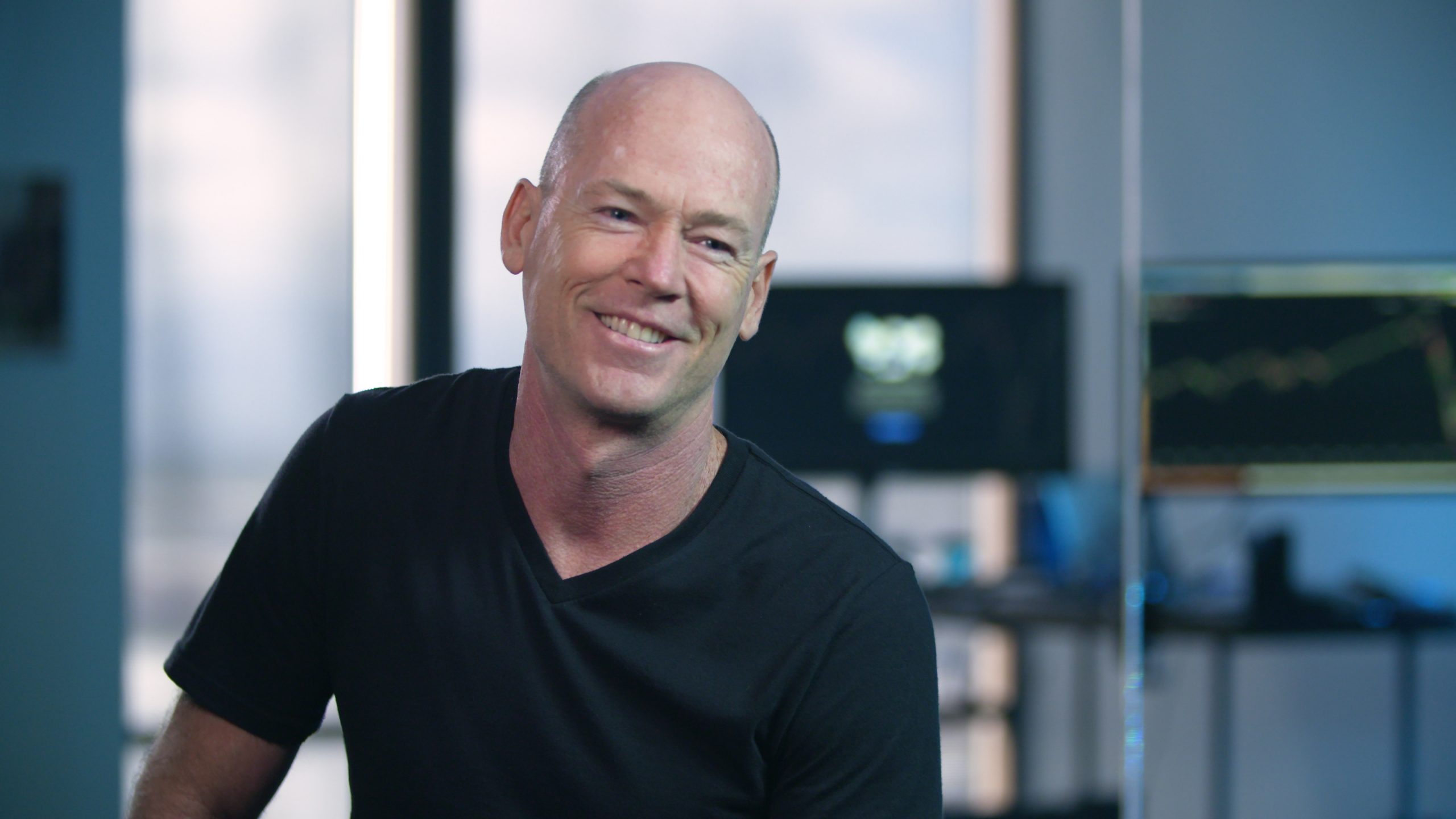

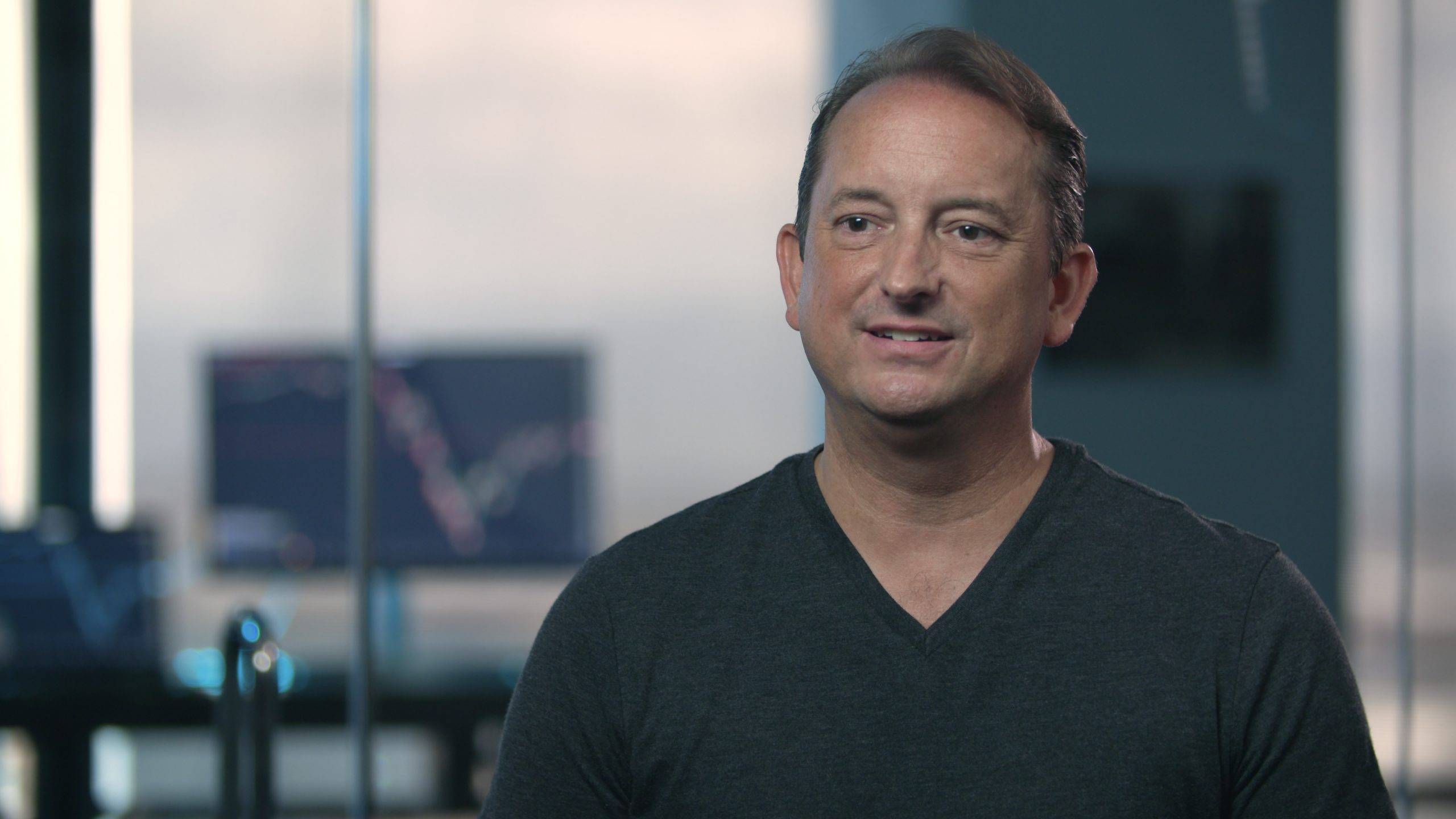

Michael Willis | CEO | Co-Founder

Mike has worked in the Wall Street industry for the past 25 years. He is the Lead Portfolio Manager for ONEFUND and previously worked for UBS, Paine Webber, & Smith Barney. Mike enjoys turning big ideas into reality.

“Do what you say you will do, do it right, and don’t stop until it’s done.”

Todd Johnson | Co-Founder

Todd worked in the mainframe software industry for 24 years before joining Mike to create INDEX. His persistence and inability to accept rejection often makes him the last man standing. Todd is hard wired to win and lives to be free.

“Obstacles and rejection always surround great opportunities, so they motivate me.”

Co-Founder ONEFUND