The Original Index Fund. Reimagined.

Track the S&P 500® Index. Top 500 companies in America.

Buy Ticker Symbol: INDEX

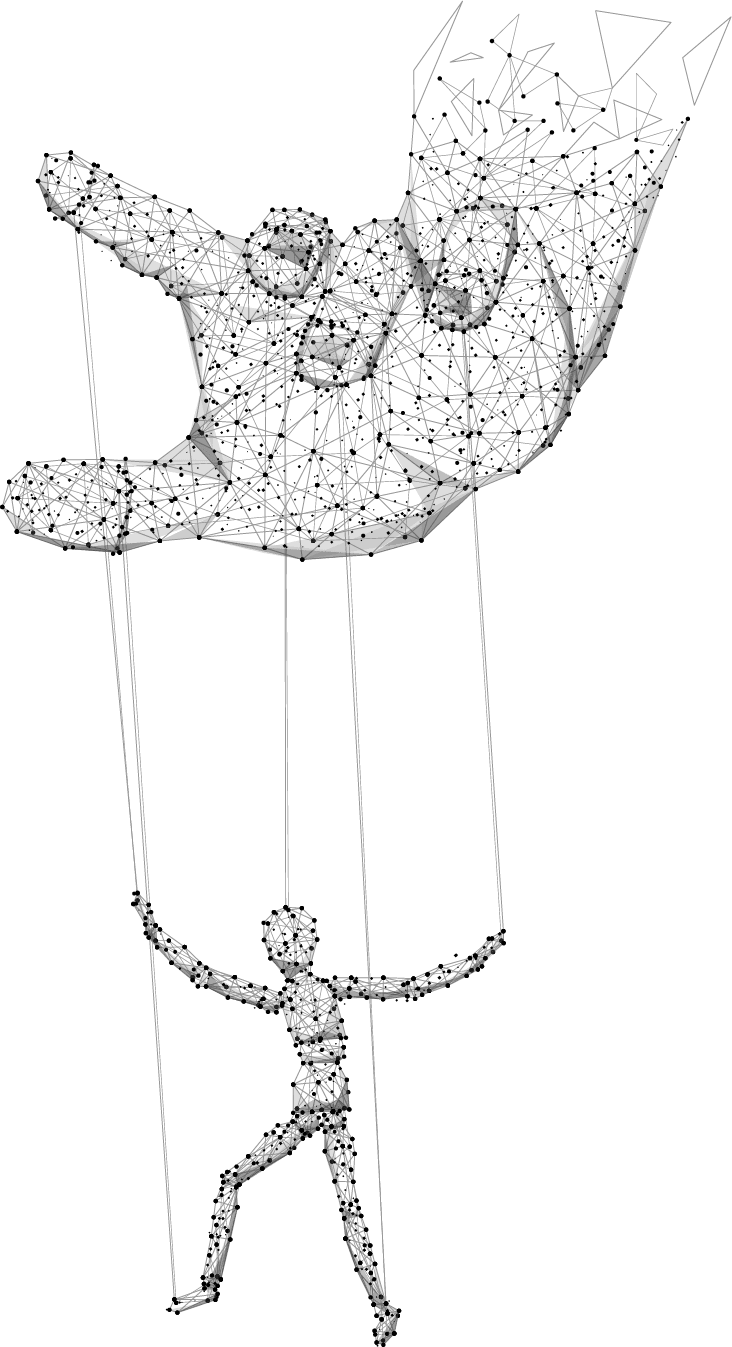

the issue

THE BIG THREE

PERFORMANCE COST

the potential future

“If current trends continue, a handful of Giant Institutions may gain voting control of virtually every large U.S. corporation.”

INVEST IN INDEX

Transfer your holding to us. Let us be your S&P 500® index of choice.

VOTE

Index Voting Choice allows you to choose a voting profile that matches your values or create your own.

IT'S YOUR TURN TO MAKE A DIFFERENCE

THE INDEX FUND THAT LISTENS TO ITS INVESTORS

ONE FUND, MANY VOICES

The more we researched, the more the answer became obvious to us. Why not ask our investors to weigh in? America is a democracy after all, why not here? Introducing – INDEX VOTING CHOICE.

Through our partnership with iconik, shareholders can create their own customized voting profiles or choose one of the preset voting profiles below:

As You Vote ESG+

Conservative

Catholic Values

Shareholder Protections

Board-Aligned

Index Voting Choice Disclaimer

Proxy Voting allows voters to vote their shares without attending the meeting. Proxy Polling is where we poll our shareholders for their opinions and factor your input before voting your shares. There is no guarantee the Fund Manager will follow the shareholder proxy polling in their final decision.

What is

“INDEX VOTING CHOICE”?

Watch the video for a quick explanation from Co-Founder, Mike Willis.

IN THE NEWS

(TICKER SYMBOL: INDEX)

INDEX is the new independent alternative. We are the index fund that offers “Index Voting Choice”, giving index investors a voice.